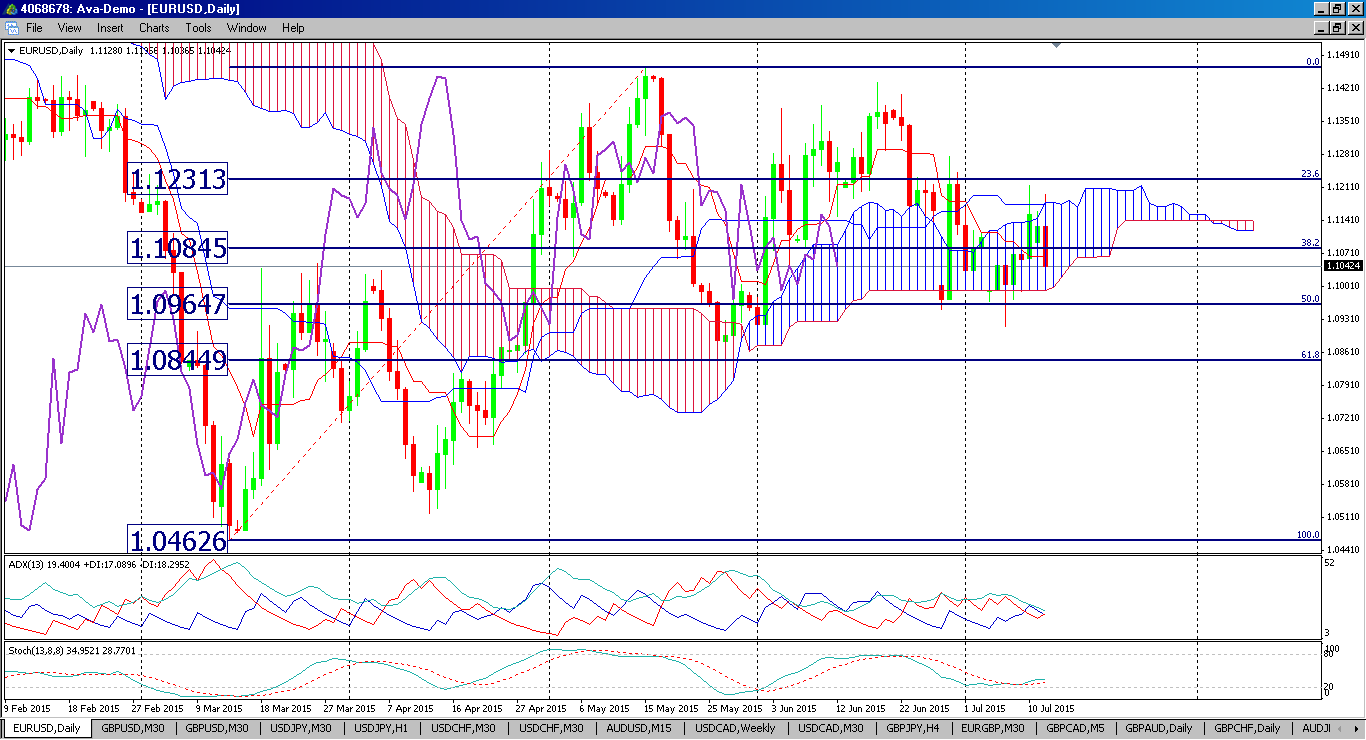

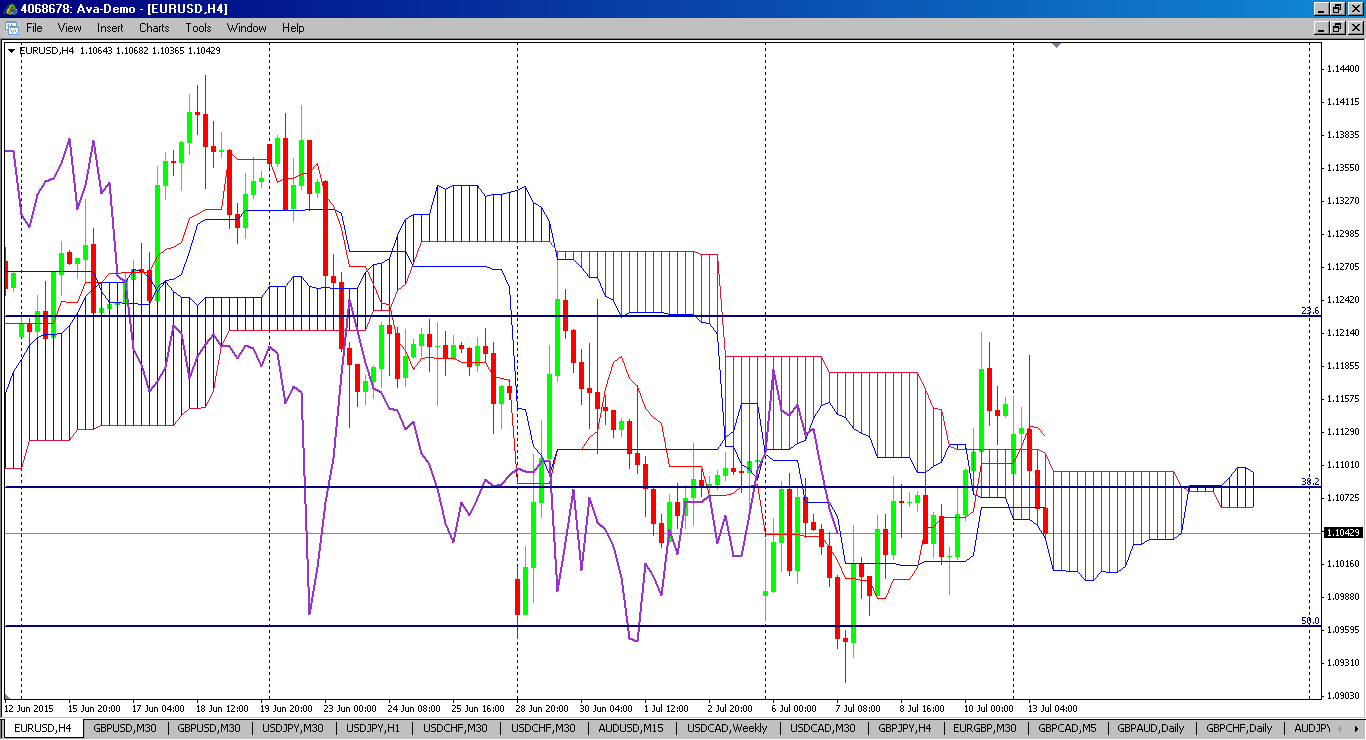

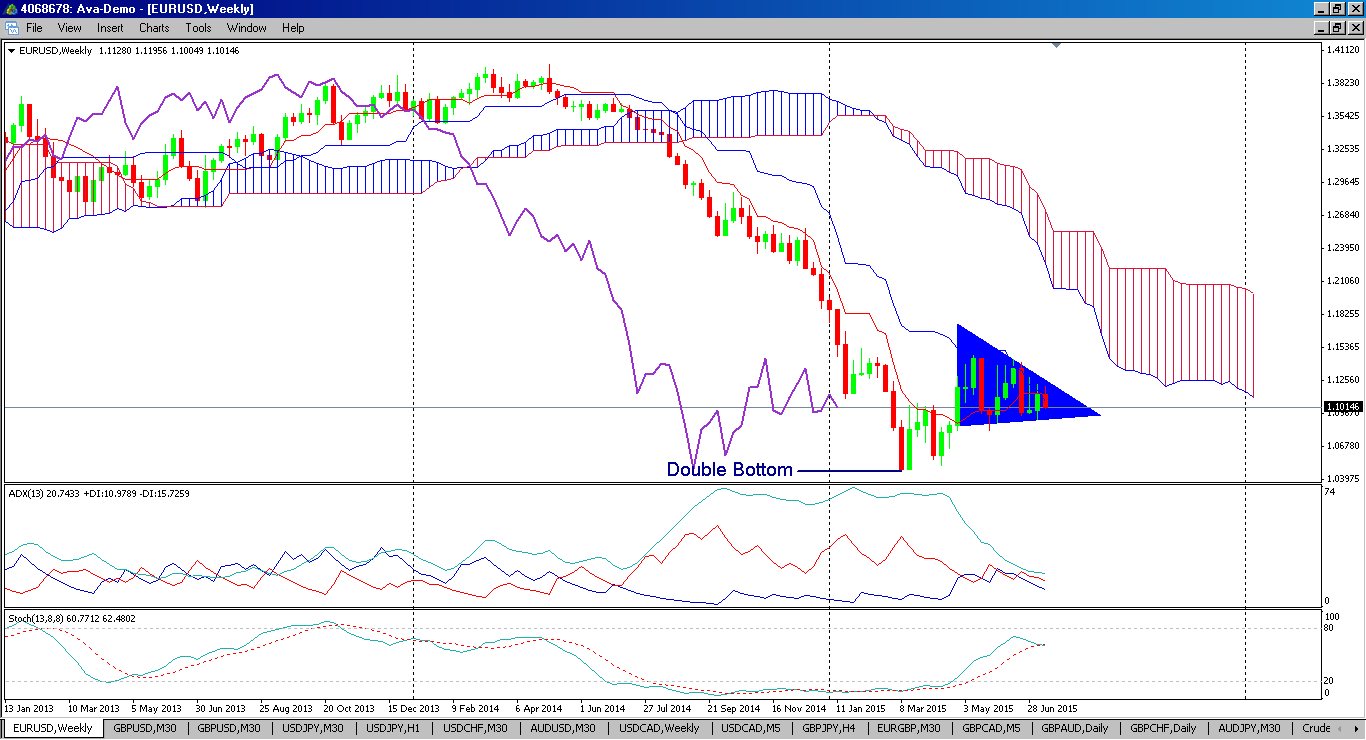

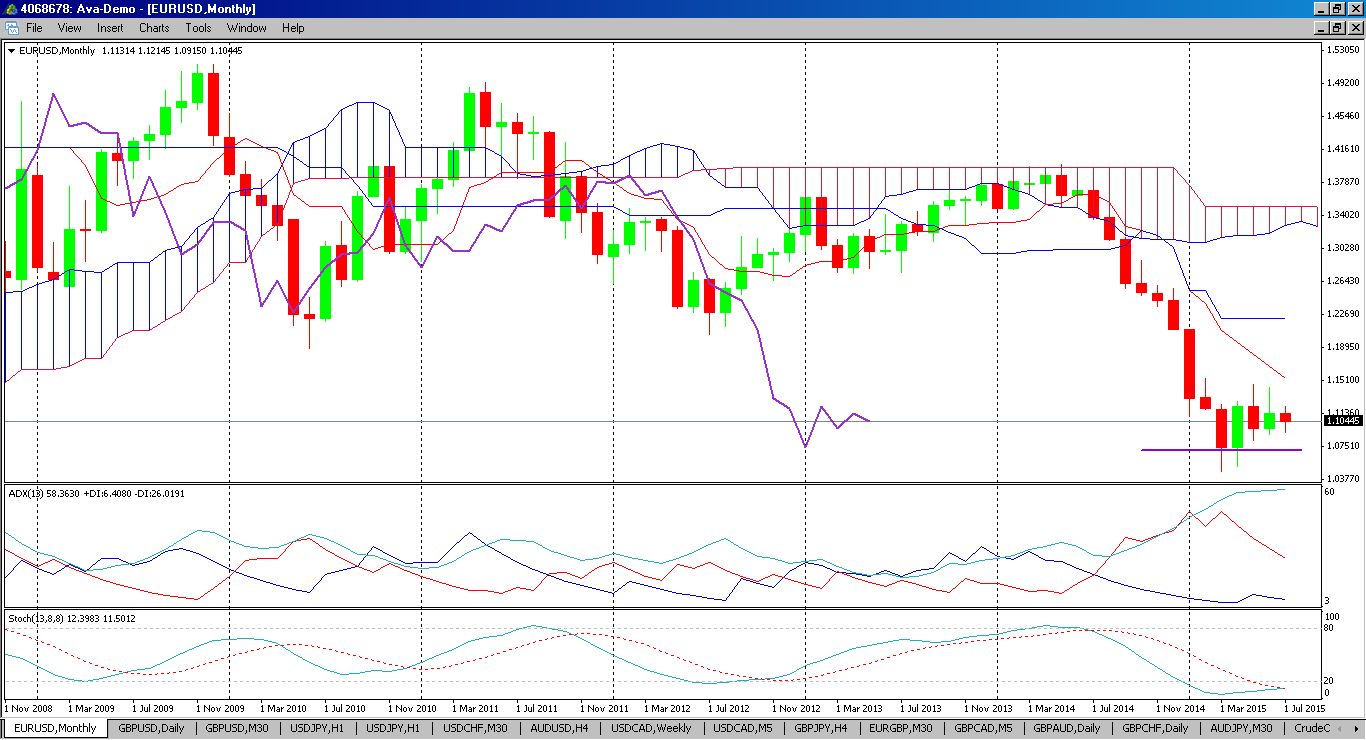

The EURUSD remains in a range which forms a bull flag on the longer-term charts. Activity has tapered off ahead of summer holidays, and news flow is expected to be quiet. Both the top and the bottom of the range have already been convincingly tested and held. Fundamentals and the chart pattern still support long term Euro strength, but that may take some time to play out. Longer-term traders should look for long trades at the bottom of the range, while short-term traders can trade within the range.

EUR/USD Weekly Chart – The bull flag enters its 6th week

For more news, analysis and information go to http://www.eurusd.co/analysis/a-well-established-range-26-june-2017.html