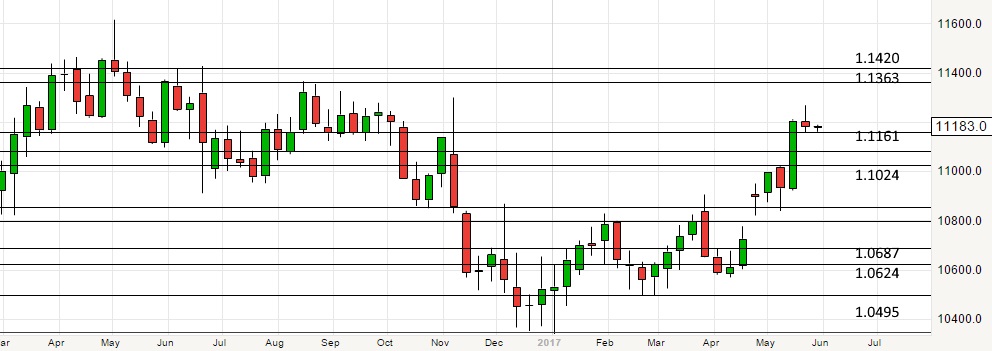

The Euro managed to find support during the trading week, initially dipping but eventually rallying close to the 1.09 level. With an eye on the 1.10 resistance, traders are considering the potential for further growth, taking into account various global economic concerns and the influence of the European Central Bank (ECB).

Euro Finds Support Near 1.09 Level, Aims for 1.10 Resistance

- Euro strengthens after dipping near 1.09 level

- Traders focus on 1.10 resistance level amid market noise

The 200-Week EMA as a Barrier to Euro Growth

- The 200-Week EMA poses a challenge for the Euro

- A break above this level could trigger a move towards 1.15

ECB’s Stance on Inflation Boosts Euro Confidence

- The ECB’s determination to combat inflation lends support to the Euro

- The currency continues to attract attention due to the central bank’s policies

“Buy on the Dip” Mentality Amid Global Economic Uncertainty

- Traders lean towards buying on dips in the short-term

- Financial distress events could derail this strategy

Market Participants Keep an Eye on 1.08 Support Level

- The 1.08 level serves as a key support in the longer term

- Traders remain vigilant in monitoring this critical threshold

Conclusion: The Euro’s recent performance and support levels indicate the potential for upside in the currency’s value against the US Dollar. Traders are factoring in global economic concerns, the ECB’s inflation-fighting stance, and key technical levels, employing a “buy on the dip” mentality as they navigate the current market landscape.