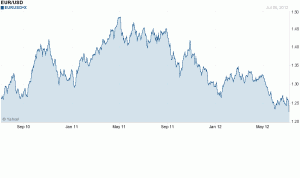

The technical picture for the Euro is quite simply that it is going up. The charts are telling us very little about how fast that may be or how deep the corrections may be.

(EUR/USD Weekly Chart – The rally resumes)

However, there is plenty of news and data this week, and fundamentals will probably drive the price. The ECB is meeting, Eurozone retail data will be released and so will US manufacturing data. On Thursday, the UK heads to the polls and James Comey testifies in the US. This is a week where anything could happen. There is a case to be made for a sharp selloff at some point, but that will need a catalyst before it happens.

(EUR/USD 4-Hour Chart – technicals will take a back seat as fundamentals dominate this week)

For the full analysis go to http://www.eurusd.co/analysis/the-euro-next-leg-higher-has-begun-5-june-2017.html